How a Savvy Service Provider can Survive and Grow – Part III August 23, 2017

Posted by Dominic Black in Uncategorized.Tags: business communications, business growth, business telecoms, Business Verticals, Cavell, Cavell Group, Cloud Communications, Consulting, CRM integration, customer service, European VoIP Summit, events, Future of Voice, horizontal solutions, Hosted VoIP, Innovation, Instant Messaging, integrations, internet, IP telephony, IT, market opportunities, market reports, market research, market update, marketing Cloud services, Matt townend, mobile, network, Productivity, reports, Research, Service Provider, Service Providers, SME, technology, Telco, telecoms, UK Market, UK solutions, UK Telecoms, UK telecoms market, UK VoIP, USP, verticalisation, Voice, voice over IP, voice services, voicemail, voip, VoIP Consulting, VoIP Market, VOIP Market research, VoIP Providers, VoIP research

add a comment

Creating Bundles of Success

Creating Bundles of Success

We have frequently heard that selling telephony services on features is simply emulating the old PBX sales approach and that hosted services benefits for a solution-based sale. Now we have figures to prove it. Cavell figures for 2016-17 confirm that where Service Providers in the channel are seeing success is in the SME where Service Providers are bundling a tight solution and with a very defined set of capabilities. The advantage of bundling is that it creates a solution-based proposition with a vertical or horizontal approach where the Channel understands their pricing, margin and the commercial and technical solution.

Vertical bundles are very strong, enabling the Service Provider to sell down a single vertical and targeting on features needed by that vertical. Cavell has seen a number of Service Providers target specific verticals by integrating into key business solutions that that vertical works with. It requires that the Service Provider understand the business processes of the customer and demonstrates this value to the customer.

Horizontal solutions can be equally strong with specialised CRM integration, or solutions with voicemail control options for road warrior use. Bundles can be commercial or technical, the secret is to tailor them to your target market and demonstrate an understanding of their requirements. A sound business approach for a Service Provider would be to start with commercial bundles and then develop into a technically integrated bundled solution as the customer requirements become clear. The approach for the Service Provider is to analyse your USPs, examine your customer base and products and then look at the rest of the market to determine your competition.

Bundling is more about how to do better with what you already have than about offering anything new.

Service Providers who embrace these opportunities and build solutions with specific value in mind are most likely to be the winners in the market.

If you wish to read more about how the market is changing, please get in touch for more information on Cavell’s market reports due to be released next week on Thursday, August 31st.

Preparing for GDPR? Everything you need to know at the upcoming European VoIP Summit. August 16, 2017

Posted by Dominic Black in Uncategorized.Tags: applications, AudioCodes, Broadsoft, Cavell, Cavell Group, Cisco, Cloud Communications, Collaboration, Communications Platform as a Service, conference, European VoIP, European VoIP Summit, events, EVS Amsterdam, GDPR, General Data Protection Regulation, Hosted, Hosted VoIP, hotel Arena, ICTRecht, internet, market research, market update, Matt townend, Michelle Wijnant, mobile, netherlands, network, Networking, Platform, Productivity, regulation, Research, security, Service Provider, service provider pass, Service Providers, technology, Telco, telecoms, Telecoms Market, Video, Voice, voip, VoIP Market, VoIP Providers

add a comment

As the General Data Protection Regulation is due to be implemented on May 25th 2018, businesses in the communications space need to plan and prepare accordingly.

In order to get you up to speed, we have organised a special session on Regulation Changes: GDPR at our upcoming European VoIP Summit on the 10th of October at the Hotel Arena in Amsterdam, presented by:

If you are a Service Provider and find yourself asking what you should do next to ensure your business complies with the new regulations, this session is for you.

Visit our website for the complete Agenda.

Have you seen our short European VoIP Summit highlights video?

We look forward to seeing you in Amsterdam on the 10th of October!

How a Savvy Service Provider can Survive and Grow – Part I August 11, 2017

Posted by Dominic Black in Uncategorized.Tags: 8x8, Analytics, Analytics Solutions, BREXIT, business communications, business growth, business telecoms, call centre, Call recording, Contact Center, contact centre, cost saving opportunities, customer service, events, Innovation, Market Data, market opportunities, market reports, market research, market update, marketing Cloud services, messaging, Productivity, reports, Research, Service Provider, Service Providers, technology, Telco, telecoms, Telecoms Market, UK, UK Market, UK solutions, UK Telecoms, UK telecoms market, UK VoIP, Voice, voice over IP, voip, VoIP Market, VOIP Market research, webinar

1 comment so far

Many businesses in the UK, small, medium and large are suffering. Pressures created by fears of what BREXIT may bring, austerity reducing the flow of money and challenging economic conditions, mean they are searching for efficiencies and cost saving opportunities to maintain and grow. These are requirements that the savvy Service Provider can meet to grow their own business. Services have become increasingly competitive and the number of Service Providers in the UK now exceeds 95, so business customers have choice, and this creates the need for Service Providers to increase the attractiveness of their offerings creating stickiness to maintain their current clients and to introduce new value-added services to increase their client base.

Value Added Services that Improve Customer Service

Good customer service is key to business success in every sector and the market research firm Cavell are reporting an increasing demand for call centre features for business telephone users beyond the contact centre. They surmise that this is a direct result of the drive to improve customer services. The business goal is to collect data from communications that will provide information to help the business to make customer communications better and enable multiple communication channels to be utilised beyond voice, including social media and instant messaging. Call Recording and Analytics are the two key basic call centre offering in demand and large platform providers are increasingly developing these capabilities, or collaborating to be able to offer these services to SME and large enterprise businesses.

Call recording has been available for a while and is a mature product. The key applications have been MIFID II for financial Service tracking and PCI compliant call recording for where credit card details are collected over the phone. The recent change, is that there is an increasing use of Call Recording to provide the business with the data to target areas for improvement through staff training and to secure details of customer interactions for future reference and to improve customer service.

Analytics is the second growing offering. Businesses are increasingly using Analytics on every customer inbound channel to gather information to help them to sell better and to understand what media their customers are using to communicate with them. This data helps them to understand how their customer is interacting. Demand for these analytic products is very high. Service Providers such 8×8 have invested in building their own analytics solutions and others are collaborating with providers like Akixi, Dubber and Tollring to be able to offer analytics solutions. The data provided helps the business to understand how to manage calls effectively and to identify future possibilities for new products.

Stay tuned for our upcoming posts where we will be covering what else we have seen makes Service Providers successful in this ever-changing and highly-competitive market.

Also, if you wish to contribute to our market research (due to be released on August 31st), please follow the links below. All participants will receive one ticket at our upcoming European VoIP Summit and have the opportunity to join our webinar on September 7th where we will be communicating our top-level results and some of the main trends we have seen in the UK Hosted VoIP and SIP Trunking market in the last six months.

Update your Diary for the 9th of March! January 16, 2017

Posted by Dominic Black in Uncategorized.Tags: applications, AudioCodes, Broadsoft, Cavell, Cavell Group, Communications Platform as a Service, Developers, European VoIP, European VoIP Summit, events, EVS London, Future of Voice, Future Voice, London, market research, market update, Matt townend, Microsoft, mobile, Networking, Panasonic Business, Platform, PSTN, QEII Conference Centre, regulation, Research, Service Provider, service provider pass, Service Providers, technology, Vendors, Voice, voice over IP, voip, voip events, VOIP Market research, VoIP research, yealink

add a comment

European VoIP Summit 2017 – QEII Centre, London

The Service Providers event of the year is coming soon and tickets are selling fast! Here are 5 reasons you should book today and avoid disappointment:

1. Insightful Panel Discussions

Key Topics to be Explored:

- Who will be the winners and losers following the ISDN/PSTN Switch Off?

- Who will run the Communications Platform of the future?

- What role do developers play in the future of communication?

- Regulation: What is changing and how does this impact you?

2. Unmissable Presentations

Meet the Industry Leaders:

3. Industry Keynotes on the State of the Market

- How to compete in the new communications landscape

- Trends in the European VoIP Markets

- What does the future of communications hold?

4. Excellent Networking & Opportunity to Share Experiences and Practices

5. Special Offer

Bring your colleagues along! The Service Provider Pass includes 3 tickets for £300+VAT offering you 20% off each ticket when bought together.

If you have any questions, please get in touch.

We look forward to seeing you on the 9th of March!

Many thanks to our Sponsors!

Gold Sponsors:

Exhibition Sponsors:

Telcos missing out on Digital Disruption opportunity whilst CPaaS providers act October 27, 2016

Posted by Matthew Townend in Uncategorized.Tags: AIRBNB, applications, business telecoms, Business Verticals, Cloud Communications, Communications Platform as a Service, CPaaS, Developers, digital disruption, digital tranformation, events, global telecoms, Innovation, Launch, market opportunities, market reports, market research, market update, Matt townend, Nexmo, Platform, reports, Research, Service Provider, Service Providers, technology, Telco, telecoms, Telecoms Market, Twilio, Uber, UC, Voice, VoIP Market, VoIP Providers, WhatsApp, Wholesale Voice

1 comment so far

You cannot help but read about how digital disruption is helping revolutionise existing businesses and enable new businesses to establish and disrupt complex industries. I think most people would also agree that at the heart of most business models are communications of different types.

So why is it that we find that Traditional model and fixed Telecoms companies are in general leaving this market opportunity to the CPaaS and development market to address?

Today, Cavell launches a report co-authored by Matthew Townend, Research and Consulting Director at Cavell, and Mike Wilkinson, one of the most respected senior marketing figures in the Technology market, former VP Product Marketing at Broadsoft and a pioneer in the whole UC and VoIP marketplaces.

In the report “The Communications Platform as a Service Market – Market Opportunities for Service Providers”, Cavell are exploring why companies like UBER, AIRBNB & WhatsApp all have chosen CPaaS providers like Twilio to power the transformation we are witnessing.

The paper addresses why the longstanding traditional Service Providers have not been able to embrace this opportunity, and what they might have to do in the future to be relevant both to these large scale global players, but also to their traditional national Enterprise customers who seek to establish new business processes and value propositions.

Matthew Townend, commented:

“As we move into a period of Digital transformation, we want to have real-time communications embedded into all sorts of business and consumer applications, and users want communication delivered in the context of their business and personal lives, however, not in the way vendors and communications providers prescribe it. Communications providers are going to have to deliver CPaaS platforms and capabilities that enable this change. “

“We are already seeing Business customers who demand their communications be imbedded in their vertical applications, as in their business they spend their life in say a hospitality business process tool. They do not want to receive it in the PBX or Cloud vendors UC all singing all dancing portal.”

For more details on the report please click here.

Cavell are Co-Hosting an industry dinner with the Internet Telephony Service Provider Association (ITSPA) in London, where we will be exploring these issues with a group of different service providers whilst also enjoying a great dinner and networking opportunity. Matt and Mike will both be at the dinner. For more details and how to book tickets please visit our website.

Cavell’s European Research Shows VoIP Markets at Very Different Stages of Development October 12, 2016

Posted by Dominic Black in Uncategorized, VoIP Numbers.Tags: Cloud Communications, European VoIP, france, germany, italy, Launch, Market Data, Market figures, market reports, market research, market update, Matt townend, netherlands, portugal, reports, Research, Service Provider, Service Providers, spain, Telco, UK, Voice, voice over IP, voip, VoIP Market, VoIP Providers

2 comments

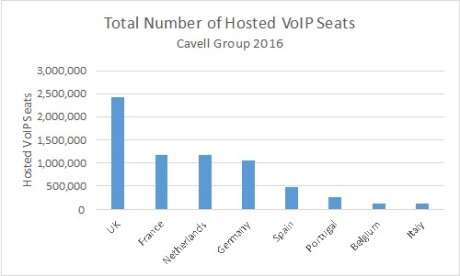

Amsterdam – 11th of October 2016 – Cavell Group today launched its European VoIP research which includes detailed studies of the French, German, Dutch, Belgian, Italian, Spanish and Portuguese markets.

Cavell can see that the UK is the largest market in terms of number of customers, however, the Dutch market continues to be the most developed. The French and German markets are showing signs of growth and maturity with increasing numbers of Service Providers launching a service.

The research shows three groups of countries in terms of market maturity with Netherlands and the UK leading the way, followed by France, Germany and Spain, with Italy and Portugal being the least mature.

Cavell also has seen a particular focus in the French market which is likely to lead to strong growth in the coming year.

Dominic Black, Senior Analyst at Cavell Group, stated: “Each market operates with slightly different dynamics and we see different pricing approaches and platform choices by the market. It would be fair to say that no two countries are the same in terms of their development or their individual market dynamics.”

The research team is happy to share further comments and views on their findings, so should you have any queries, please contact Francisca Dinga, Marketing & Research Assistant at Cavell Group:

Email: francisca.dinga@cavellgroup.com

Telephone: +44 (0) 1206 911393

The total number of SIP Trunks in the UK market passes 1m trunks! March 6, 2014

Posted by Dominic Black in Uncategorized.Tags: Cavell Group, illume Research, market update, Research, SIP trunking

6 comments

The last 6 months of 2013 saw the IP/SIP Trunking market continue to grow and it passed the one million Trunk mark for the first time. At the end of 2013, the total number of trunks in the market was 1,087,161, an increase of 198,558 trunks in the last 6 months of 2013. Growth rates have increased from the slight slowdown in the first half of 2013 with the Large Enterprise sector being the key driver of the growth.

The current market leaders are still driving the majority of the market although we have seen growth from most of the providers that we spoke to. The number of providers in the market is continuing to expand with more market entrants either starting from scratch or entering from other international markets. illume believe that this will continue in the future as providers look to offer an international presence to their customers and take advantage of other market opportunities.

illume will launch its new reports on the 7th March, if you are looking to purchase a report please contact Dominic Black at dominic.black@illumeresearch.com

2014-2018 Forecast & Report

The 2014-2018 forecast focuses on the following areas:

1 Executive Summary

2 Market Definitions

3 Market Evolution

4 Market Forecast

5 Market Value

6 Market Dynamics

7 Pricing

8 Key Objections/Barriers

9 Enterprise Connectivity

10 List of UK IP/SIP Trunking Service Providers

11 About illume Research

If you would like to find out more about Cavell Group or illume research please visit www.illumeresearch.com

The future is about providing a VoIP platform that people can integrate and develop on, to solve both specific and generic customer problems.

The future is about providing a VoIP platform that people can integrate and develop on, to solve both specific and generic customer problems.